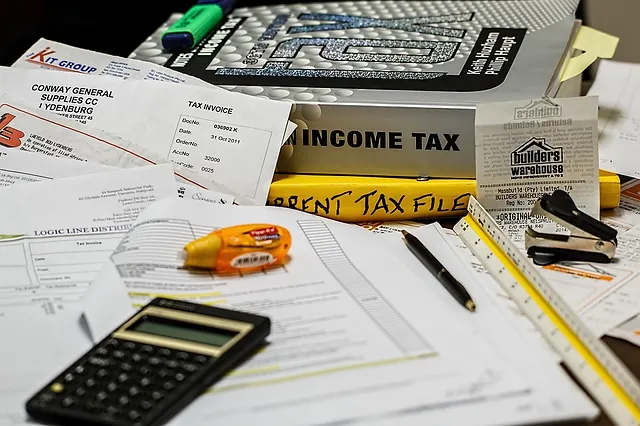

Seattle, Washington, is a booming center of innovation and entrepreneurship with a strong small company culture. Still, tax preparation frequently seems like a huge undertaking in the middle of the hustle and bustle of running a business. Financial success for small business tax preparation in Seattle, WA depends on their ability to maximize deductions and comprehend the complexities of tax laws. This post will discuss the nuances of preparing small business taxes in Seattle and offer helpful advice for a successful outcome.

Recognizing Your Tax Duties as a Small Business:

In Seattle, Washington, small businesses must pay federal, state, and local taxes, among other taxes. Sales tax, payroll tax, self-employment tax, and income tax are common taxes that small businesses may have to deal with. Business owners must familiarize themselves with these obligations and ensure compliance to avoid penalties and fines.

Key Considerations for Small Business Tax Preparation:

- Organized Record-Keeping: Keeping thorough and well-organized financial records all year long is crucial for efficient tax preparation. To effectively track revenue, expenses, and receipts, use accounting software or seek the assistance of a qualified accountant.

- Tax Classification: Your tax liability may be greatly affected by the tax classification you choose for your small business, such as a corporation, LLC, partnership, or sole proprietorship. To find the most advantageous categorization for your company, speak with a tax advisor.

- Deduction Maximization: Take advantage of available tax deductions and credits to minimize your taxable income. Common deductions for small businesses in Seattle may include business expenses, home office deductions, mileage expenses, and health insurance premiums.

- Compliance with Local Regulations: Seattle, WA, has specific tax regulations and requirements that small businesses must adhere to. Stay informed about local tax rates, filing deadlines, and reporting obligations to ensure compliance with city ordinances and regulations.

- Quarterly Estimated Taxes: The IRS and the Washington Department of Revenue frequently demand quarterly anticipated tax payments from small business owners in Seattle, Washington. Penalties and interest costs may be incurred for late estimated tax payments.

To successfully prepare small business taxes in Seattle, Washington, one must be diligent, meticulous, and well-versed in tax laws. Small business owners can minimize their tax burden and expedite the tax preparation process by maintaining organization, optimizing deductions, and obtaining professional aid when necessary.

Keep yourself updated on any modifications to tax rules and regulations so you may modify your tax plan as necessary. Small businesses in Seattle can prosper financially and complete their tax requirements with the right strategy and preparation.